© 2006 UrbisMedia

“America’s Finest City,” as it likes to call itself, just shelled out $20 Million to some accounting firm that took it to the cleaners for producing a report on the culpability of what public officials, by neglect, corrupt practices, or both, shoved this rich city to the brink of bankruptcy. There’s enough in that saga to regale our good readers on the subject of corruption of the public trust that sleazes down from the Republicans in Washington to the Republicans in San Diego. But I take the present theme from what some argue is the cause of that threatening bankruptcy—the pension fund for public employees.

First, a disclaimer. I am a public employee pensioner, but even if I were not, I would not join the chorus of anti-government types who begrudge every penny in the public fisc that they would rather see expended to buy hummers or pull slots at the local casino. But there is a larger issue, one that transcends San Diego—and the ken of right-wing morons—and that is the relationship of retirement to the economic system. What are the consequences of an expanding social cohort who spend increasingly protracted, un-productive, and expensive periods in retirement.

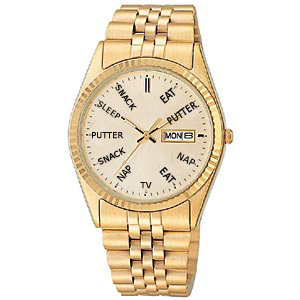

For most if human history there was no retirement—no going on cruises to watch glaciers fall off Alaska, no riding around in golf carts or sitting in HMO waiting rooms. People fell over at whatever kind of work they did to keep themselves alive, and that was that. If they lived long enough to become unproductive, like the Eskimo women whose teeth fell out, they were left behind, or on an ice floe, as polar bear lunch. No getting your hair blue-permed and going to the casino, no puttering with your boat or motor home; if you didn’t produce, you were history.

People never expected that they would need a “nest egg,” pensions, 401Ks, mutual funds, reverse mortgages, and a medical plan that covers organ replacement, a dental plan that covers implants, and a vision plan that lets you read the DMV eye chart so you can get a license at an age when you grandparents were already dead for forty years. They never figured they would to put enough away for several years in a comfortable retirement or nursing home. People never expected that they might have a stage of life after their working years that could be almost as long as the period of their working years. They never used to figure that they needed a good pension plan to take them through those years. [1]

The economy never figured on this either. But these people are using up one hell of a lot of resources. They create pollution, clog the streets, freeways and aisles of supermarkets, use oil, and they spend a lot of money—the great part of it in the last few years of their lives—on health care, pharmaceuticals, nursing homes, and medical procedures. In the process they engender lot of jobs; retirement homes have to be built, geriatric centers, hospitals, drug companies. But is it all worth it? A guy spends thirty years selling life insurance, then retires and spends almost as much as he made for another thirty years of sitting around.

You can see where I’m going with this (or the corner I’m painting myself into). Are we approaching so sort of zero sum circumstance where people build up a pile of capital and then expend it during a period of economic indolence and non-productivity? Is that the concern than underlies the concern about Social Security—as the length of retirement extends and the consumption of health care that attends it expands with it, can the working cohort support the non-working cohort? And then, what happens when they get to retirement age?

As fewer and fewer people do not drop over at work and have a long period of retirement to look forward to they naturally become more concerned about their nest egg. CEOs just negotiate multi-million dollar salaries and stock deals, which they often get for screwing the workers out of the pensions they have vested with the companies they run into the ground. There are no longer any guarantees that all those pension contributions will be there when you’re ready to wind your gold watch and hop in the golf cart. If you worked for Enron, or any number of airlines and other corporations you didn’t need to be told that.

But Municipal corporations are no less vulnerable to this trap. San Diego’s politicians—long hampered by Proposition 13 and subsequent Republican administrations that like to play games so they won’t have to ask people for taxes—got themselves in a big mess playing with public employees pensions. Now those republicans that like long term debt rather than asking for taxes can’t even float a bond because the city is fiscally unsound. Those pesky pensioners are expensive for municipal corporations as well. [2]

So, should we just line those pensioners up and shoot them? Of course not. After all, I am retired myself. Maybe I’m just beating up on my fellow retirees because I am in denial about being in their cohort. [3] Anyway, I’m still trying to be “productive”—if you can call bugging people with essays like this “being productive.”

Well, OK, you can shoot the guy I saw the other day wearing a sly grin and the T-shirt that said in big letters “I’M RETIRED, Do it Yourself.” Him you can shoot.

___________________________________

©2006, James A. Clapp (UrbisMedia Ltd. Pub. 8.22.2006)

[1] Of course there were no guarantees that there would be anything left by the time they breached retirement. Inflation might suck most of the purchasing power from their nest egg, or, if you vested with an Enron, an airlines, or other larcenous American corporation you might spend your retirement years as a Wal Mart greeter.

[2] Ironically, New York City, which was often cited by San Diegans as the liberal spending sort of city has a better pension situation than San Diego. See:

http://www.nytimes.com/2006/08/20/nyregion/20pensionside.html?ex=1156737600&en=112d77e45d111d13&ei=5070&emc=eta1

[3] OK, I will confess. I have a “senior” Octopus Pass that I use on the transit in Hong Kong, and used my senior status for a cheaper plane ticket and movie theater admission.