Randomly rational thoughts on Economics and the fate of the nation

© 2009, UrbisMedia

Following all the excitement and glitter and glamour of the election have you noticed how suddenly boring politics in America has become. Well, its “the economy, stupid”, or the stupid economy, or the stupid Bushies who ruined the economy. So now President Obama is like some guy push-brooming the gutters of Wall Street of the human trash and financial documents that aren’t worth the paper they are written on (even when those papers have presidents’ pictures on them.) The Bush aftershocks keep coming: more layoffs (600K last month, the most since that other Republican dolt, Ford, was stumbling around.)

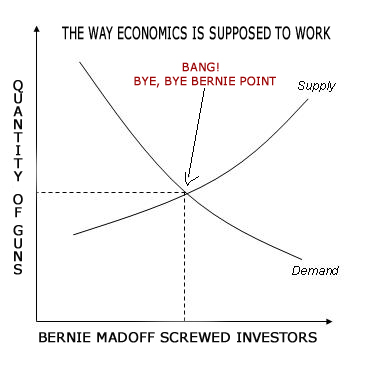

Way back in 1962 I received a bachelor’s degree in Economics. A few years later, a third of my Ph.D. was devoted to urban economics and political economy. Those achievements don’t quite make me an “economist,” since I never really “did” economics beyond some economic base reports as a planning consultant. But I am much more of an economist than some of he right-wing clods and Libertarians from Mars who go to (anti) taxpayer meetings and think they know what the hell they are talking about. The supply of economic idiots well exceeds the demand.

I don’t admit much to my economics background these days. People might ask about “sub prime Ponzi hedge fund derivative swaps,” or some such Wall Street scam that is closer to “three card Monte” than economics. I tried to beat “three card Monte” once in Hyde Park, London, and lost five pounds; I think it cured me of ever trying Wall Street scams. Anyway, I learned that economics is more than just curves and carts and supply and demand.

People actually believe that Economics is actually more sophisticated and arcane than rocket science or micro-biology. It’s not. You can explain the fundamentals of economics to grade school kids. Give me a box of matches, a bag of pennies and I’ll show you (these days a couple of rats and roaches might add reality). We don’t do it in school, because it actually gives kids ADD. Kids today are only interested in their allowance anyway, or their Visa card limits.

You can also try to explain it with a lot of mathematical googah—which is one of the main reasons I decided not to continue studying econ. Vasilly Leontief, a Nobel Laureate in Econ and leader of “input-output analysis” once said that the whole sophisticated structure increased predictability perhaps a couple percent. Economic models have t make a a lot of assumptions about what people will do. They often assume that people will be “utility maximizers,” rather than people who will have a couple of drinks with Bernie Madoff. I hold with economic historian Robert Heilbroner who said, “Mathematics has given economics rigor, but alas, also mortis.”

Ultimately, all economics is about utility. Utility, that’s the word you need to concentrate on. It’s the little seed from which it al grows.

Harf: “Hey, Gnurd, see this stone?”

Gnurd: “Yeah, so what?”

Harf: “Look, I cracked it and now it cuts meat off this Mastodon.”

Grurd: “Cool. I’ll give you my fire sticks for that stone.”

Harf: “OK, but I want options on future fire sticks from you at three per cutting stone.”

Gurd: “Deal. Whaddaya say we sell some of those futures to the others in the clan—we really don’t have to make anything.”

Harf: “Cool, and if somebody invents the knife, we’re still ahead.”

You see, in economics, you are supposed to actually make something that has utility, and when you take something you add value to it, which is how people use their talent and labor to get paid for their work. Try to sell something without utility—something useless—right. Maybe. Sure, now we’re talking something else about economics—rationality. Rationality means that you have to know something about utility; if you don’t you just might get “taken.” Investment banks do perform a function of moving money to places where there might be something being made that has utility—but it doesn’t have to be that way. They can get into the business of betting on the future of something and even taking out insurance on the bets. All investment is, in effect, about betting on the future, that the stock will appreciate, that your home value will always rise, that you don’t work for Enron or your job will not go to China or India, etc.

A casino economy isn’t really about making anything of value. It’s about betting on the odds that there just night be demand (that is, effective utility) for something that might be made in the future. But it might not happen, in which case you lose, and the (investment) house–casino usually comes out because the boys running the bailouts from Washington are old Wall Street boys. Of course, in recent years these casino-houses have been screwing each other over by passing “bad paper” around like hot potatoes. No honor among thieves.

I also left Econ because it seemed to me that making kids economists also seems to make them homely or ugly. Being someone who has once again failed to win my local “Brad Pitt Look-Alike Contest” I can say that. I notice that when I took my Econ courses in college. Fr. E looked like Kermit the Frog, Dr. K like the Pillsbury Dough Boy, and Dr. G had the pallor of a cadaver. (Ironically, Dr. G, who gave me a “C,” ended up having his work reviewed by me as a consultant to the urban planning firm I was with for a while. Then he really looked dead.) Take a look: Hank Paulson looks like some perpetrator from a slasher film, Bernake has that goofy white beard and black tonsure, Paul Volker looks like a shaved Wookie from Star Wars, and then there is Alan Greenspan, a guy with a face that perhaps only his mother could love (apparently to smack with a 2 by 4) who could be Milton Friedman’s slightly more ugly brother. Even our latest Nobel Laureate in Econ, Paul Krugeman has the surprised innocent expression of a gnome in the midst of a rectal exam. Have you noticed that the stock trading commercials in TV always features some serenely-trusty-looking type left over from Law and Order or some such show as their spokesperson, always talking about how their firm cares about you as an individual (like those guys they used to have in doctor’s white coats pushing cigarettes not all that long ago)? But it’s the uglies behind the scenes making the decisions with your money. Don’t trust the uglies because making lots of money is the only way they can get trophy wives, and they don’t care about you.

Back at college the one thing I learned was that you should never, ever, take a Micro-Econ course at 8AM (or maybe any other time). My eyes started crossing and supply and demand curves started wiggling around on the blackboard like the hairs in sink water. Check that, I learned something else in Micro—that economics is not funny. (Although economists can be at times. Galbraith: “Economics is extremely useful as a form of employment for economists.”) The only funning thing that ever happened in Mirco is that one morning the college basketball star, who sat right in front of me had a cold, and in a panic sneeze reached into his pocket for a handkerchief that turned out not to be there. Instead, he mistakenly grabbed the in side of his pocket and ripped it out of his pants with a tearing sound that blended with the roar of his snuffled sneeze. It was so damn funny I nearly soiled myself. (OK, maybe you had to be there.) I can’t think of Micro-Econ without hearing that ripping sound.

A lot of that sneaky Wall Street stuff is not necessarily taught in university Economics departments, but to the greedy bastard children of Economics Departments—Business Schools. Economics is a discipline, a study that takes its name from how to run a household (oikos + nomos, if you want to go original Greek with it.). Business is, well, as Don Vito Corleone used to say, business—you screw people, or kill them if you have to. Business schools are about marketing, accounting, and profit; the difference between the tail and the dog. There is a major difference between the public interest and private interest. They do intersect a various points, but once you start believing that the public interest is the private interest you get . . . well, take a look around. There is a reason why Econ departments are in Colleges of Arts and Letters and Business schools are on the other side of campus—they represent different values about society. Be wary of pin stripes.

There is a fiction that people who make huge salaries, have stock options and bonus and bailout packages get these perks because they are “worth it” (even when they destroy the very corporations they head.) We now are ale to see what a great fiction that is. These a men who have used their political influence to skew the rules of financial behavior to their favor to engage in insider trading, dominate or influence boards of directors and stockholders and, generally, operate more like lobbyists and con men than people who care about their corporations, much less their country.

So now the news is all economics, all bad economics. But these guys will be back, you can lay money on it. They are “entitled”; we used to have aristocracies, now we have “econostracries.” “Let them eat cake has become “let them invest in derivatives.”

Will Obama’s bright star be diminished by the gloominess of the dismal science? All this news, the suspicions of back room deals and CEOs coming to Washington with veiled threats that if we don’t give them their yachts and executive jets they won’t give us their economic expertise to save the country and the world. How will this dashing new prez survive among the ugly money-grubbing number-mumblers? Don’t think for a minute that they will not find other names and ways to give themselves bonuses and perks to fatten their deposits in the Caymans. Obama is up against the greed that has replaced the utility of the American economic system. To start with I think he needs a good, sharp, mastodon cutting rock.

____________________________________________________________

© 2009, James A. Clapp (UrbisMedia Ltd. Pub. 2.21.2009)